April isn’t the only time of the year to reduce your taxes, on contrary it’s done throughout the year. Sometimes, it’s just about setting up a system to save taxes on a long period of time, like the technique proposed in this article: cash damming.

“This technique consists, roughly speaking, in converting some personal debts into business debts to take advantage of tax deductions on the interest. In order to do so, you should open an account into which you would deposit your gross revenue in its entirety. From this account you would pay for nondeductible personal expenditures : taxes, groceries, etc. Then, you would open a second account, usually a credit line, with which you would pay exclusively for your business expenditures.

Since the credit line pays for the business expenditures, there’s a surplus in the first account. This amount helps to repay personal loans faster. For instance, if we spend annually $50,000 in personal expenditures a $150,000 personal mortgage on 3 years is conceivable. During these years, you can also accumulate $150,000 in business debt. The difference in this case is that the business debt interest is deductible, whereas the personal mortgage interest are not. So, we want to get rid of this personal debt quickly.” Explains Marc-Étienne Salvail, financial planner at GestionFTM.

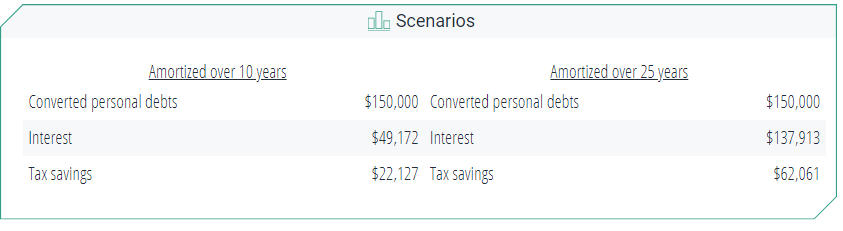

For example, let’s take a look at a $150,000 mortgage loan amortized over 25 years, with a 6% interest rate and a 45% tax rate. Once this debt is converted into a business debt, thanks to cash damming, you would save a total of $62,061 in taxes.

A TECHNIQUE TO APPLY TO MANY SITUATIONS

The trick is simple: you should keep the liquidity generated by your gross revenue in order to make your loan payments for which interest is nondeductible and use a credit line to pay for disbursements for which interest is deductible. So this technique can be used in many situations:

- catch-up for unused RRSP or TFSA contributions

- payment of overdue taxes

- payment of a universal life insurance premium

- etc.

For instance, a banking institution will not grant a loan to allow you to contribute to your RRSP or TFSA. On the other hand, it will grant a credit line for your business because it increases at the same rate as your RRSP or TFSA contributions.

CONDITIONS TO BE FULFILLED

This technique can be used by unincorporated self-employed workers, by general partnership partners and by owners of income properties if they are owned personally. You can take advantage of this technique when the following conditions are fulfilled:

- you should be an individual in business whose enterprise is unincorporated

- you earn a high taxable income

- you have significant personal debts (mortgage loan, car loan, credit cards, etc.)

- you have significant business expenditures.

100% LEGAL, BUT NOT WITHOUT PITFALLS

Cash damming isn’t a new strategy and before 2003, one was facing a grey zone when trying to get the most out of this technique. Thus, even though it has been shown to work quite easily, beware of some pitfalls.

Did you know?

The CRA confirmed the validity of the strategy in its response of February 27, 2003, including confirmation of the non-application of the anti-avoidance rule. In addition, in March 2015, the CRA published a first version of the S3-F6-C1 income tax folio, in which it clearly states in paragraph 1.34 of the said folio that this technique is consistent with the wording of the law.

In the case of a separation, while or after reimbursing the first mortgage on the residence, it would involve some costs associated to the partitioning of the family patrimony. Since everyone’s situation is different, there are many different planning strategies based on cash damming technique. Moreover, it’s important to note that the credit line must be used solely to pay for business disbursement eligible for interest deduction. That’s to say, not every disbursement is eligible!

To apply this technique without any risk and effectively, it’s important to master the tax field. Therefore, we highly recommend the assistance of a financial planner before you implement this technique. We’ll never state too much that in order to succeed in real estate investment, it’s really important to be surrounded by a team of professionals!