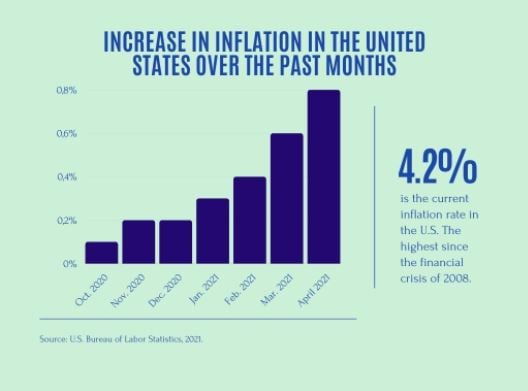

U.S. consumer price jumped 0.8 percent in April after rising 0.6 percent in March, pushing the rate of inflation to its largest level since September 2008.

The COVID-19 pandemic has contributed to an unusual recession, and the recovery will not be easy. Many businesses have closed while others could not carry out as they used to. As a result, many people lost their jobs and most of the population found themselves staying at home most of the time.

The Consumer Price Index—which measures price change by comparing, through time, the cost of a basket of goods and services—increased over the previous year to 4.2 percent from -2.6 percent for the period ending in March. This is the highest level in approximately 13 years.

Because of the economic effects of the pandemic, inflation has increased over the past months. How? Interest rates were at low levels for years but especially over the past year in order to help Americans cover their expenses during these hard times. Now that the pandemic seems to be easing, the U.S. economic recovery is kicking into gear and energy, lumbar, pvc and other materials are increasing in price.

Americans are rushing to do activities they could not do over the previous year such as dining out with friends and travelling. This behaviour had businesses such as vacation resorts raise their prices as their demand was growing.

Excluding food and energy prices, the core CPI rose 3.0 percent over the past 12 months and 0.9 every month. This was its largest 12-month increase since 1996.

Other large CPI increases include used cars and trucks with a 21 percent raise and 9.6 percent in airline fares.

Shelter—a key CPI part—rose 2.1 percent over the same time last year and 0.4 percent in April. Medical care also rose 1.5 percent over the past 12 months.

Food prices increased 2.4 percent over the past year. The food consumed at and away from home also rose 0.4 percent in April.

As for energy prices, the number surged to 25 percent from a year earlier including a 49.6 percent increase in gasoline and 37.3 percent in fuel oil. The raising in gasoline prices is the largest since January 2010.

Other energy components increased in the earlier month. Electricity prices rose 1.2 percent and 2.4 percent in natural gas.

While we saw a rise in energy prices over the past 12 months, most energy categories showed a slight decline in April falling 0.1 percent after rising in each of the last 10 months.

As the pandemic caused a widespread shutdown of the U.S. economy, this led to a particularly low inflation rate.

Investors are also worried about the increase in inflation. Since the U.S. interest rates have risen over the past six months, investors think the inflation may even rise higher.

“If you are a multifamily real estate investor, stay active in your portfolio management,” says CEO of the MREX, Nikolaï Ray. “Don’t lock in long-term debts to create a mismatch between DSC—debt service coverage ratio—, NOI—net operating income—, and potential leverage. Manage your liquidity,” he continues.

Federal Reserve officials say the increase in inflation is merely temporary. They believe that inflation will ease by next year once the pandemic subsides. Now, with people going back to work and vaccinations among the American population, Federal Reserve officials predict the economy will shortly recover.